Tired of Winning, Apparently

Dear Republicans: Donald Trump's economically incoherent tariff policy has the potential to tank the economy and derail the rest of his agenda. Dear Democrats: Hold off on the self-congratulations.

TIRED OF WINNING

In 2016, Donald Trump promised, “We’re gonna win so much that you may get tired of winning.” His advisors must have reached that point, as evidenced by the bizarre, incoherent “Liberation Day” tariff policy they helped craft. Trump supporters have enjoyed a heady three months of action on DEI, antisemitism, energy, NGOs, deregulation, border control, Hamas, Houthis, and more, but solidifying those changes will require a strong economy, support from friendly nations, and continued Republican control of Congress. The “April Tariffs,” as I’ll call them, put all that at grave risk, as indicated by roller-coaster markets and Republicans sounding fire alarms.

Sections below discuss why: [1] The case for tariffs is mostly based on long-debunked superstitions; [2] Legitimate arguments for tariffs are few and feeble; [3] The particular structure of the April Tariffs appears drug-induced; and [4] Democrats contemplating high-fives and we-told-you-so’s might ponder why they supported Trumpian tariffs for so long and handed Donald Trump the power to impose them unilaterally.

DRUM-BEATING, CHILD SACRIFICE, AND TARIFFS

Ancient societies believed solar eclipses caused plagues, deaths of kings, crop failures, etc. To stave off the anger of gods or God, they beat drums, flung arrows, slaughtered livestock, and sacrificed children. This madness subsided as science demonstrated that eclipses were predictable and benign.

Antique societies similarly feared trade deficits. Their religion—“mercantilism”—taught that trade deficits impoverish a nation, benefit the wealthy, and result from other countries’ malice. Mercantilists viewed tariffs the way their ancestors viewed drums, arrows, cattle-slaughter, and child-sacrifice. Their beliefs were demolished by David Hume (1752), Adam Smith (1776), David Ricardo (1817), and centuries of theory and data. Unfortunately, economists haven’t been as successful as astronomers at dispelling superstition.

I strive to respect viewpoints contrary to my own. I believe Biden’s stimulus spending was futile and destructive, that the Fed should focus on inflation and not real growth, and that socialism is ruinous. But intelligent people feel otherwise, and I respect that; theory and data are hazy, and different people have different priorities. Tariffs are different. No one who understands trade seriously believes tariffs spur economic growth. A talented economist can postulate theoretical conditions under which that might happen, just as a talented physicist can specify conditions under which spacecraft can travel faster than light. Nice intellectual exercises with limited practical value. Let’s examine the superstitions.

(Note: The numbering of Superstitions #5 through #9 have been corrected from an earlier error)

Superstition #1: Tariffs aren’t taxes

Fox News’s Greg Gutfeld said:

“A tariff is not a tax if you don't buy the goods. And I'm tired of the media calling the tariff a ‘tax.’ It’s the opposite!”

Gutfeld can also say, “I’m tired of the media calling hamburger a ‘food.’ It’s the opposite!” By Gutfeldian logic, a real estate tax isn’t a tax if you don’t buy a house, an income tax isn’t a tax if you don’t earn any income, and a sales tax isn’t a tax if you don’t buy groceries. White House Economic Shaman Peter Navarro trumpeted:

“The message is that tariffs are tax cuts!”

(Internet sage “Iowahawk” said “Congratulations to Peter Navarro for surpassing Ana Navarro as the World's Stupidest Navarro.”)

Superstition #2: Tariffs are taxes on foreigners

Tariffs are simply rebranded sales taxes on specific goods and sellers. Americans will write the checks, and pain will be divided between Americans and foreigners according to which side is more price-sensitive. The burden of pain will differ across countries, products, and Americans. And they only protect American jobs to the extent that the pain falls on Americans (not foreigners).

Superstition #3: Tariffs increase national prosperity

Tariffs can sometimes benefit segments of a country’s economy by harming the rest of the population even more. Steel tariffs might enrich American steelmakers by $100 billion by making other Americans poorer by $200 billion. When those other Americans buy fewer products with steel, even the steel industry can end up poorer.

Superstition #4: More foreign investment can spur lower trade deficits

President Trump speaks of the importance of attracting foreign investment and of reducing America’s trade deficit. This is logically equivalent to someone in Kansas City saying, “I want to relocate my family to some city that is closer to New York and is also closer to San Francisco.” A trade deficit in goods and services is just the mirror image of inward flows of international investment. If America is a superior place to invest in land, business, education, etc., foreigners will buy more American stocks, bonds, land, and factories than Americans buy foreign stocks, bonds, land, and factories. That capital inflow will yield an equal increase in America’s overall trade deficit. This is arithmetic, not theory.

Superstition #5: Trade deficits indicate weakness

Trade deficits and surpluses are neither inherently positive nor inherently negative. America ran trade surpluses during the Great Depression, as Americans were too broke to afford imports, and capital flowed outward as the global economy sank. America ran deficits during the Reagan Era boom, as Americans were wealthy enough to buy lots of imports, and America had the best investment opportunities.

Superstition #6: Lower overseas wages are unfair to American workers

To believe this, you have to believe that residents of New York City and San Francisco face unfair competition from car manufacturers in Alabama and Tennessee, where wages are lower (thanks to lower cost of living). By April Tariff logic, New York and San Francisco ought to impose high tariffs on autos made in the South so auto manufacturers will build factories in Manhattan and Pacific Heights. In most cases, lower wage costs overseas also reflect lower efficiency. In 1992, Ross Perot opposed NAFTA because, he said, lower wage rates in Mexico conferred an unfair advantage. More sensible heads noted that it took multiple Mexican workers to make in an hour what a single American could make in that time; thus, hourly wage rates were lower in Mexico, but wage costs per unit of output were similar in both countries.

Superstition #7: Trade has destroyed American manufacturing

Manufacturing employment has shrunk over the past half-century, both in absolute numbers and even more as a share of overall employment, but mostly because of domestic competition and automation. Some manufacturing did go overseas as Americans moved into higher-earning occupations. Likewise, 150 years ago, 50% of Americans worked in farming, versus 2 percent today—but we don’t fret that 48% of Americans have “lost their farm jobs.” To be sure, there are some worrying reasons why some manufacturing has gone overseas. For example, eliminating shop classes on American schools a generation ago left us bereft of skilled craftspersons. But tariffs won’t fix that.

Superstition #8: Trade deficits can’t go on forever

As long as an economy is growing fast enough, a country can run a trade deficit every single year for the next five centuries and still grow wealthier with each passing year. For a small analogy: if you have a growing business and sell shares in it every year, proceeds from stock sales can allow you to buy stuff for the rest of your life and die richer than you are today.

Superstition #9: Bilateral deficits indicate weakness and perfidy

This myth forms the very core of Trump’s Liberation Day tariffs, and it is here that Trump’s advisors have done their country, their president, and their party the greatest disservice. We’ll cover why in a separate section below.

PLAUSIBLE ARGUMENTS FOR TARIFFS

Tariffs are an unusually crude tool—like performing open-heart surgery while wearing oven mitts. No matter what goals you hope to pursue, there’s almost always some tool that will do it more efficiently and with less collateral damage. Still, here are some niche reasons why someone might consider a tariff:

Raising Revenue: Tariffs are taxes and thus raise revenue. If that’s the goal, then say so, and don’t pretend they’ll enrich Americans.

Favoritism to particular industries: If you want to enrich the steel industry, just recognize that a steel tariff will enrich the steel industry but only by impoverishing the rest of America.

National security: If you fear Chinese dominance in rare-earth mining, tariffs can induce American companies to seek alternative sources. There are probably better tools than tariffs for doing so.

Strategic pressure: President Trump threatened to impose a destructive tariff on Colombia unless that country accepted two planeloads of deportees; supposedly, the Colombian president backed down in response. In “The Gulf of Trump,” I wrote, “[T]here is some logic to this use of threatened tariffs. It’s analogous to nuclear weapons, however—effective as a threat but self-destructive and counterproductive if actually used.” It’s also best to use on one or two countries at a time.

Reciprocity: There’s some logic to “reciprocal tariffs,” where America says, “You set a tariff rate for our goods, and we’ll set the exact same tariff rate for yours.” This incentivizes other nations to lower tariff rates, perhaps till both countries have no tariffs at all. It’s a risky, but defensible strategy whose ultimate purpose is to eliminate tariffs. (NOTE: The April Tariffs bear absolutely zero resemblance to reciprocal tariffs, despite the administration calling them “reciprocal tariffs.”)

Madman Theory: Here’s the one and only legitimate defense that one can muster for Trump’s April Tariffs—that they are specifically designed to look insane and cataclysmic, thereby scaring the world into eliminating tariffs altogether and moving to a regime of freer trade. This is like Richard Nixon’s “Madman Theory”—forcing the North Vietnamese to negotiate by convincing them that he was irrational and volatile. I doubt that this explains the April Tariffs, but if this is what happens, I’ll tip my hat, admit I didn’t see it coming, and say “thanks.”

PUTTING THE METH IN METHODOLOGY

The April Tariffs are based on Superstition #9: “Bilateral deficits indicate weakness and perfidy.” This is the idea that a trade deficit with an individual nation is inherently bad and results from the other nation’s malice. The weird April Tariff formula for each country is:

To the untrained eye, this might look sensible, as it seems to have something to do with international trade. But this formula primarily suggests that Trump’s economic advisors are heavy users of methamphetamine. The most surprising thing about this formula is that its authors did not incorporate data on the country’s soccer scores, relative humidity, and average hat size.

This formula merely assumes that a trade deficit (IMPORTS minus EXPORTS) is a bad thing. It is reduced by a 50% “discount,” a number pulled out of someone’s posterior. The formula metes out punishment for variables over which the countries have no control and offers no rewards for increased openness to American goods. Take Vietnam’s numbers (which include a slight rounding error):

This imposes a ruinous tariff on a country that is friendly to the U.S. and which welcomes American goods. This tariff rate would devastate the Vietnamese economy, shred relations with America, and likely drive Vietnam closer to China. There’s nothing that Vietnam can do to reduce that trade deficit other than by ending relations with America or finding some way to launder exports through some third country.

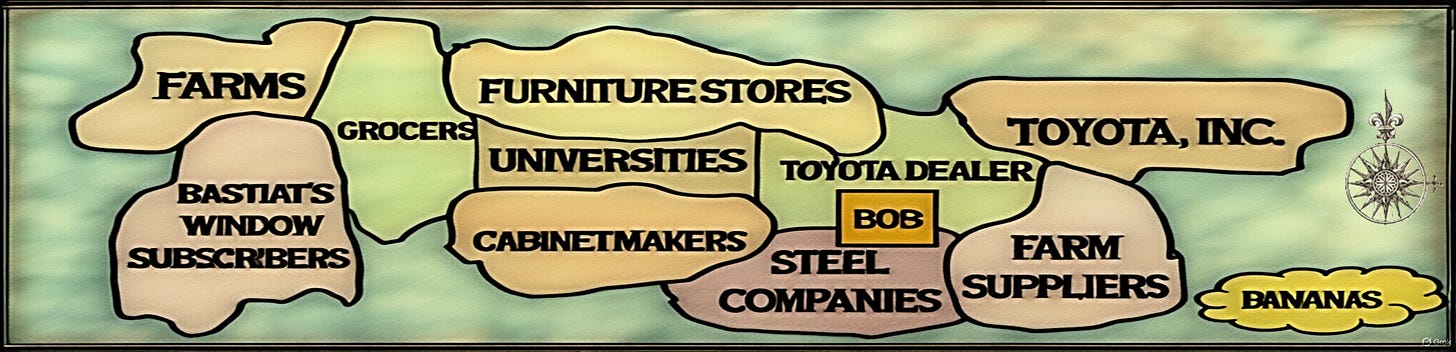

In a world of nearly 200 nations, there’s zero reason for anyone not high on drugs to expect any two nations to have balanced trade. I’ll explain why via a small-scale analogy, represented by the following map of Bob’s World (I’m “Bob”):

Bob runs a perpetual trade deficit with Grocers, as he buys lots of stuff from them, but they don’t buy anything from him. That will never change. Put a 46% tariff on Bob’s purchases of groceries, and his trade deficit shrinks because he buys fewer groceries. (He also pays more for the groceries, with the tariff going to Bob’s government.) Grocers are harmed because they lose business. But there’s still a trade deficit; Bob still buys some groceries, and grocers still don’t buy anything from Bob. The deficit only disappears when the tariff is so high that Bob stops buying groceries, quits his job, and grows his own food.

Similarly, grocers run deficits with Farms and growers of Bananas. Farms run deficits with Farm Suppliers. Bob runs a deficit with the Toyota Dealer because he buys new cars from them and only sells them old cars. Toyota Dealer, on the other hand, runs a deficit with Toyota, Inc.; they buy cars from corporate HQ, but corporate HQ isn’t buying much from the dealer. Toyota, Inc. runs a perpetual trade deficit with Steel Companies—purchasing vast tonnage of steel and selling only a modest number of vehicles to Steel Companies.

Bob runs chronic deficits with Furniture Stores, who run chronic deficits with Cabinetmakers, who run deficits with Toyota Dealer when they purchase delivery vehicles.

Bob runs trade surpluses with Universities (who pay him to teach) and Bastiat’s Window Subscribers (who pay for subscriptions). Bob, on the other hand, doesn’t buy anything from Universities or Bastiat Window Subscribers. Universities and Bastiat’s Window Subscribers run chronic trade deficits with Furniture Stores. Etc., etc., etc.

By April Tariff logic, Bob is ripping off Universities and Bastiat’s Window Subscribers—and the cure is to require Universities and Bastiat’s Window Subscribers to pay a tariff on their purchases from Bob. By the same logic, Toyota Dealer is ripping Bob off, and the best cure is to require Bob to pay a 46% tariff on purchases from Toyota, so the $30,000 car he wanted to buy now costs $43,800. By Gutfeld logic, this is not a tax, because Bob can refuse to buy a car and walk around town, instead. By Navarro logic, the 46% tariff that Bob must pay is a “massive tax cut.”

SMOKE WHERE THE SUN DON’T SHINE

Two hundred years ago, doctors used tobacco smoke enemas to (unsuccessfully) resuscitate drowning victims and to treat colds, hernias, abdominal cramps, and other ailments. Today, tariff advocates use precisely the same technique to treat a wide range of real and imaginary economic woes.

And if you’re a Democrat inclined to gloat about all this, keep in mind that your party was the primary locus of pro-tariff activism from the end of WWII till Trump descended his golden escalator in 2015. It’s easy to find quotes exhibiting Trump-like praise of tariffs from Joe Biden, Elizabeth Warren, Tammy Baldwin, Amy Klobuchar, Nancy Pelosi, Chuck Schumer, Bernie Sanders, Barack Obama, Hillary Clinton, and others. And it was Democratic Congresses that surrendered their constitutional control over tariffs via the Trade Expansion Act of 1962 (Section 232), the Trade Act of 1974 (Section 301), and the International Emergency Economic Powers Act (IEEPA) of 1977. Actions have consequences.

‘UR JOBBES!!!

Perhaps the most succinct statement of Mercantilism comes from Bartholomew Greave the Elder’s A Treatis vppon Forayn Contrees and the Fruites of Labour (1483):

“They ben destroyinge our economie. They rypped us of. In the immortall wordes of the bardes of Southe Parck, ‘They toke ‘ur jobbes!!’”

I think you are making the same mistake as others. This is not a math argument or a syntax argument. It's a political argument. All the wonks are doing the math. Trump is doing the politics. Trump: I am going to increase the tariffs. Others: How much? Trump: A lot! Others: Let's talk.

In politics the only math that's important is the counting noses math. You want more noses on your side than are on the other side. What's more important? The Electoral College numbers or the Popular Vote numbers?

If math ruled there wouldn't be a national debt problem. If math ruled Robert E. Lee would have crunched the numbers and not gone to war. Ditto Hitler.

Trump could be doing Abbot & Costello math and it wouldn't matter. It's a political problem and it needs a political answer. Whether he has the "right" answer is the question. And it's not a math question.

Fwiw a supermajority of Americans believe in astrology https://theharrispoll.com/wp-content/uploads/2024/02/Astrology-Survey-February-2024.pdf